Feb 14, 2021

Feb 1, 2021

Jan 29, 2021

Updated: Sep 14, 2018

It is very easy to pay your Philippine Travel Tax online before your travel date. You can complete it in less than 10 minutes as long as you have all the details about your flight itinerary and your credit card information. Let me give you a brief information about the Philippine Travel Tax.

The travel tax is a levy imposed by the Philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended.

Pursuant to Section 73 of Republic Act No. 9593, fifty percent (50%) of the proceeds from travel tax collections shall accrue to the TIEZA, forty percent (40%) shall accrue to the Commission on Higher Education (CHED) for tourism-related educational programs and courses, and ten percent (10%) shall accrue to the National Commission for Culture and Arts (NCCA). (Source)

There are different types of travel tax like full travel tax, the standard reduced travel tax and the privileged reduced travel tax. Today we are only going to discuss the full travel tax since this is the usual tax that travellers are paying for their international flight.The regular rate is P1,620 for economy class and P2,700 for a first class passage.

.

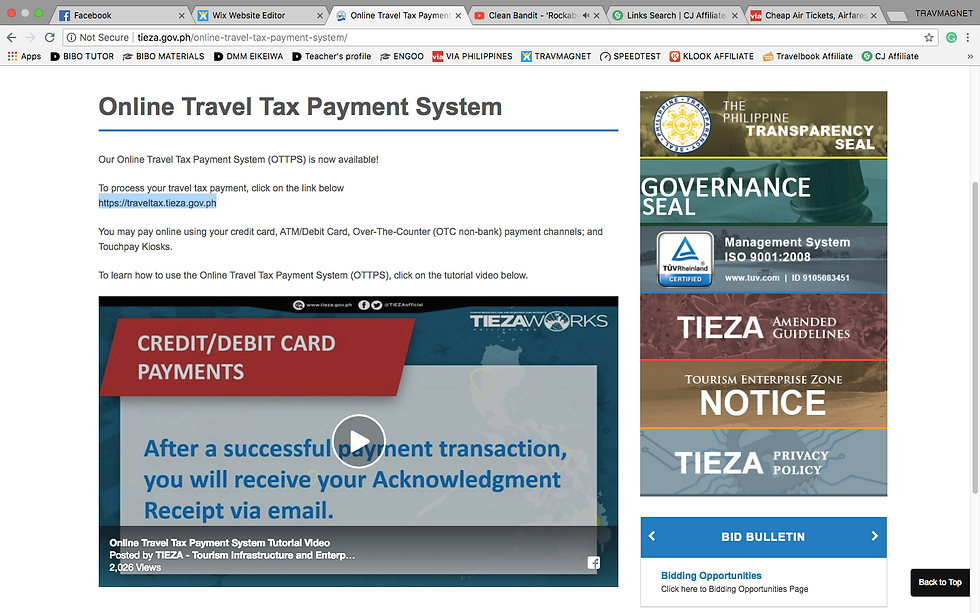

Go to TIEZA's website at http://tieza.gov.ph and click the tab "Travel Tax" and click the drop-down menu and click on "Pay Travel Tax Online"

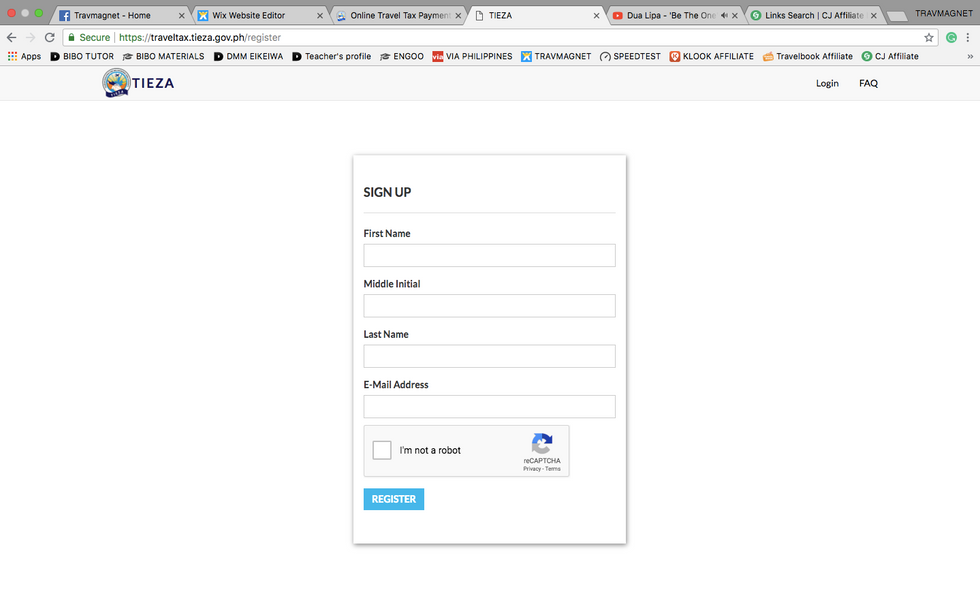

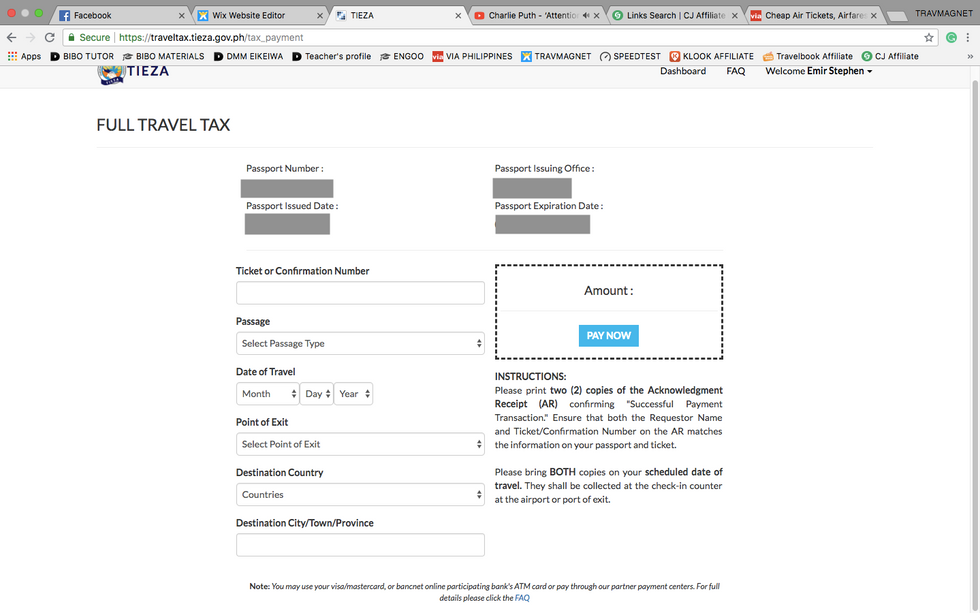

Go to https://traveltax.tieza.gov.ph. Create your profile and enter all the required information. You will receive a confirmation email that your registration was successful.

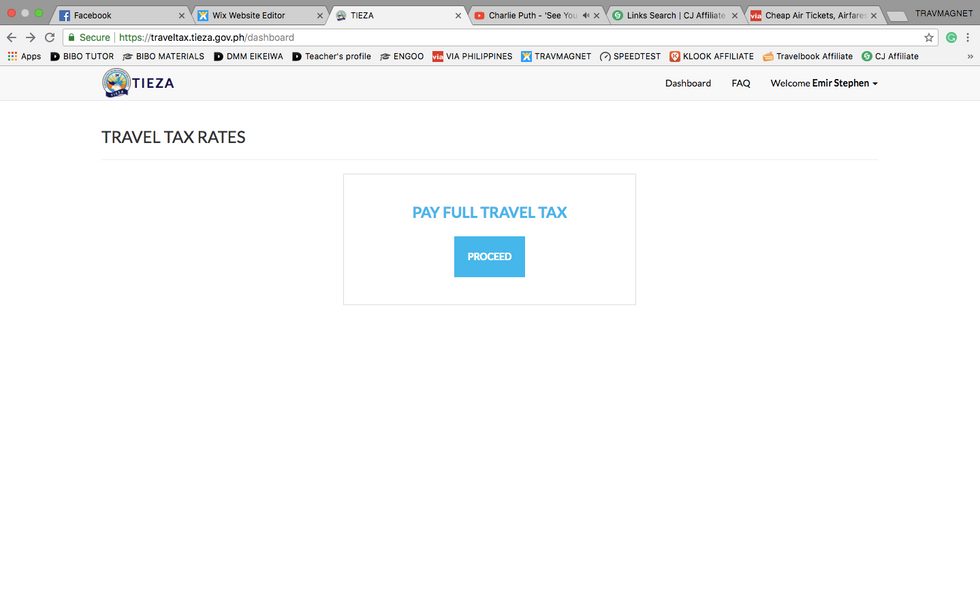

After creating your profile, click "Proceed" and enter the necessary information and click "Pay now".

You can pay using the following options below:

Credit Cards (Visa only for now, Mastercard coming soon)

ATM / Debit Cards (bearing the Visa logo)

Over The Counter (OTC non-bank) channel partners

Touchpay Kiosks

After completing the payment, you will receive a confirmation email that your payment has been fulfilled.

For your convenience, you can check-in using your airline's mobile app or on their website if you don't have any check-in luggage for faster proceedings.

Please make sure to print out two (2) copies of the confirmation email and inform the representative at the check-in counter that you already paid the travel tax online. They will keep one copy and the other copy is for your records. You may ask the airport staff to staple it together with the travel documents that you have so you won't misplace just incase they need to verify it again before entering the boarding gates.

Lastly, enjoy your trip and Live, Travel & Don't be sorry.

Comments